Today, knowing how to open a demat account in Zerodha is very important. Zerodha is a top choice in India for trading. It makes investing easy with a simple interface and fast services.

Having a demat account with Zerodha is safe for your stocks. It also makes trading better. We will show you how to open a Zerodha demat account easily.

Key Takeaways

- Zerodha is a popular platform for trading in India.

- Understanding the demat account opening process is key for new investors.

- A demat account securely holds your stocks and simplifies trading.

- Zerodha offers a user-friendly interface for all users.

- Opening a demat account is essential for participating in the stock market.

Introduction to Zerodha Demat Accounts

Zerodha is a top discount brokerage firm in India. It offers a modern trading platform. The introduction to zerodha demat accounts shows how easy and cheap trading can be. These accounts help you buy and hold stocks.

Zerodha’s demat accounts make managing investments simple. You can hold your securities online, no need for paper certificates. This makes buying and selling faster and safer.

Zerodha wants to make trading affordable and clear for everyone. A zerodha review often talks about how it cuts down on costs. This makes it popular with both new and experienced traders.

Zerodha is all about the digital world. It has a friendly interface and great customer support. This means everyone can use their demat accounts easily. As more people learn about money, Zerodha demat accounts are becoming a smart choice.

What is a Demat Account?

A demat account is key for trading stocks and securities. It’s a digital account that lets you hold securities without physical certificates. This makes buying and selling shares easier and faster.

The Securities and Exchange Board of India (SEBI) makes sure demat accounts are safe and clear.

Understanding the Role of a Demat Account

A demat account does more than just hold securities. It’s a place to manage stocks, bonds, and mutual funds. It makes storing and moving securities easier.

With a demat account, you can see your investments anytime. You can also check prices and make smart choices fast. It’s a big step forward in investing.

Why You Need a Demat Account for Trading

Many ask why they need a demat account for trading. It’s needed to buy and sell shares on the stock exchange. Without it, you can’t trade securities.

Having a demat account also keeps your investments safe. It reduces the chance of losing or damaging physical certificates. Plus, you can do trades online, making everything quicker.

Benefits of Opening a Zerodha Demat Account

Opening a Zerodha Demat account has many good points. It’s great for both new and experienced traders. Zerodha offers low costs and easy-to-use tech, making trading better.

Cost-Effective Trading Options

Zerodha has many affordable trading options. There’s no charge for equity delivery trades. This means big savings for investors.

There are no hidden fees. This lets traders focus on their investments without worrying about costs.

Easy Access to Stock Markets

The platform makes it easy to get into stock markets. It has a simple interface for smooth trading. Investors can explore markets in real-time.

Zerodha also has cool features like limit orders and margin trading. These help investors grab market chances.

Zerodha is a top pick for those wanting to save money and easily access markets. It’s perfect for managing investments well.

How to Open Demat Account in Zerodha

Opening a demat account with Zerodha is easy. It lets investors keep their securities online. Knowing how to open a demat account in Zerodha is key for trading in Indian stock markets. The easy steps make it simple for many to start investing.

- Visit the Zerodha Website: Go to the Zerodha website first.

- Select Account Opening: Find the option to open a new account.

- Fill the Application Form: Fill out the online form with your personal info.

- Upload Documents: Send in your ID and address proof.

- Complete KYC Process: Do the Know Your Customer (KYC) check to set up your account.

- Receive Account Details: Once verified, you’ll get your account details by email.

These steps to open a Zerodha demat account are online. This makes it easy for users to start trading quickly. The digital world has made investing easier and more accessible to everyone.

Zerodha Demat Account Opening Process

Opening a Zerodha Demat account can be done in two ways. You can choose online or offline. The online method is quicker and easier for many.

Online vs Offline Account Opening

For online account opening, follow these steps:

- Go to the Zerodha website and fill out the form.

- Use your Aadhar number and mobile number for KYC.

- Upload the needed documents.

Offline opening means you need to go to a Zerodha branch. You’ll fill out forms and give documents. This takes more time.

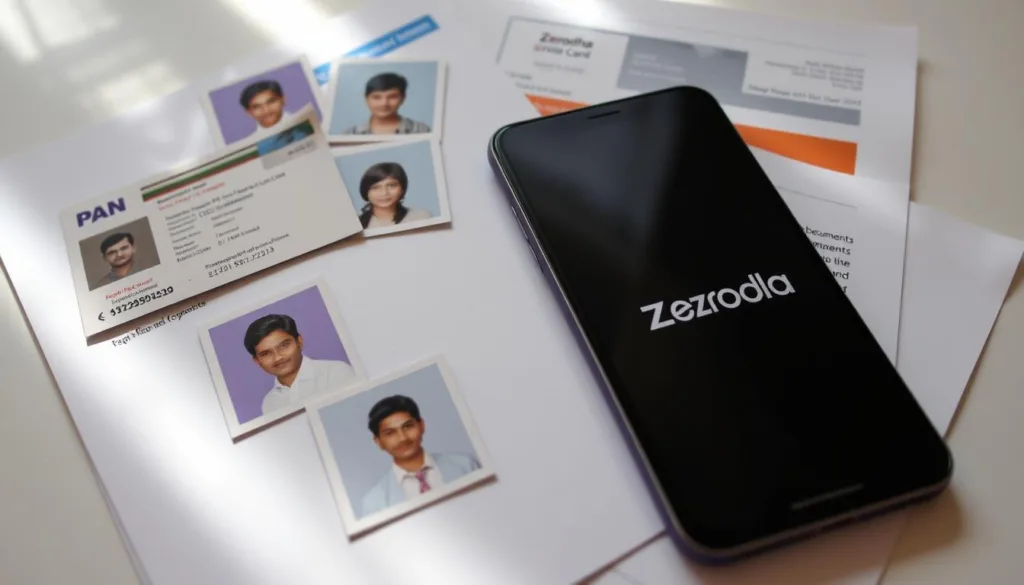

Understanding the Required Documents

To open a zerodha demat account, you need certain documents. Here’s what you’ll need:

| Document Type | Description |

|---|---|

| Government ID Proof | Aadhar Card, Passport, or Voter ID to verify identity. |

| Address Proof | Utility Bill, Bank Statement, or Ration Card for address verification. |

| Bank Account Statement | A copy to link your bank account for transactions. |

Step by Step Guide for Zerodha Demat Account

Opening a Zerodha Demat Account is easy. This guide will help you get all the info you need.

- Visit the Zerodha Website: Start by going to the Zerodha website.

- Select Demat Account Opening: Find the Demat account option on the homepage and click it.

- Fill Out the Registration Form: Fill in your name, mobile number, and email on the form.

- Provide PAN Details: Enter your Permanent Account Number (PAN) for the account.

- Verify Your Identity: Upload your address proof and photo ID for KYC verification.

- Set Up Your Login Credentials: Make a username and password for your account.

- Review and Agree to Terms: Read and agree to the terms and conditions.

- Submit Your Application: Click the submit button to finish your application.

- Confirmation: Watch for an email or text about your application status.

This guide makes opening a Zerodha Demat Account easy. It helps you start trading smoothly.

Zerodha Account Opening Procedure

Opening a Zerodha account is easy and fast. It’s designed to be simple. You can apply online or offline.

First, go to the Zerodha website or app. There, you can start a new account. Fill out the form with your name, address, and phone number.

Then, you need to verify your identity. If online, upload your Aadhar, PAN, and bank info. Make sure the scans are clear.

For offline, download the form or get it from a Zerodha branch. Fill it out and bring your documents to the branch. The staff will help with the checks.

After checks, you get a confirmation email. This means your account is ready. Learning how to open a Zerodha demat account will make trading better for you.

Documents Required for Demat Account Registration in Zerodha

To open a Zerodha demat account, you need the right documents. These include ID proofs, address proofs, and bank details.

Government ID Proofs and Address Proofs

Here are the documents you need for ID and address:

- Aadhaar Card

- PAN Card

- Voter ID

- Driver’s License

- Passport

These are the *demat account documents required* by Zerodha. Make sure they are up-to-date and easy to read.

Bank Account Information

Having the right bank details is key for easy transactions. You’ll need:

- Bank statement or cancelled cheque

- Account number

- IFSC code

Having these documents for zerodha account registration ready makes opening your account faster.

| Document Type | Examples | Purpose |

|---|---|---|

| Government ID Proof | Aadhaar, PAN, Voter ID | To verify identity |

| Address Proof | Utility Bill, Bank Statement | To confirm address |

| Bank Account Information | Cancelled Cheque, Bank Statement | Linking bank account for transactions |

Zerodha Demat Account Application: An Overview

Understanding the zerodha demat account application process is key. It makes things smoother. Here, we share tips to help you fill it out right and fast.

Preparing Your Application

Start by getting your documents ready. You’ll need ID, address proof, and bank info. Fill out the form carefully. Check your answers twice to skip delays.

Common Mistakes to Avoid

Small mistakes can cause big problems. Here are some common mistakes in application to watch out for:

- Incorrect personal information, such as name or address.

- Missing required documents or signatures.

- Providing incomplete bank account details.

- Neglecting to check document validity dates.

Keep checking newswali.in regularly to get the latest update

Tips for Opening a Demat Account in Zerodha

Opening a demat account in Zerodha might seem hard. But, with the right steps, it’s easy. Here are key tips for opening a demat account in Zerodha to help you.

- Choose the Right Time: Apply when it’s not busy to skip delays.

- Prepare Your Documents: Make sure all papers are correct and easy to find. Check your ID and bank statements well.

- Utilize Zerodha Resources: Use Zerodha’s tutorials and FAQs to clear up any questions.

- Follow the Application Steps: Stick to the online guide for each step in the demat account opening tips. This helps avoid mistakes.

- Stay Updated: Keep an eye on your application status after you send it. This helps fix any problems fast.

Understanding Online Demat Account Setup

The online demat account setup has changed how people trade stocks in India. Platforms like Zerodha make it easy to start from home. The whole process is quick and smooth, thanks to online checks.

Online Verification Process

The online check is key to opening a demat account. It has a few important steps:

- Aadhaar Authentication: Use your Aadhaar number to prove who you are.

- Selfie Verification: Take a selfie live with Aadhaar to confirm your identity.

- Document Submission: Upload your ID and address proof online for review.

This online check makes setting up fast. You can start trading quickly after applying. Make sure your documents are correct and follow all steps for a smooth setup.

What to Expect After Applying for Your Zerodha Demat Account

After you apply for a Zerodha Demat account, you might wonder what happens next. The zerodha account confirmation process is easy and quick. You’ll get a notice saying your application is being checked in a few hours. This notice might come by email or SMS.

After checking your application, you’ll get a yes or no in 2 to 5 business days. How fast it is depends on your documents. Make sure all your documents are right. Zerodha might ask for more info or clear up any questions.

If you get a yes, you’ll get your account details and how to start. Always check your email for the link to activate your account. Knowing what to expect makes starting your trading journey easier.

- Develop an innovative app for opening demat accounts that combines a user-friendly interface, instant KYC verification, and personalized investment insights, differentiating it from existing platforms like Groww, SBI, and Angel One.

How to Create Zerodha Demat Account: Final Steps

After you apply for a Zerodha demat account, you need to finish some important steps. You must go through a detailed verification process. This makes sure your info is correct and you’re ready to trade.

The verification checks your ID and address. After they check your documents, you get a confirmation email. This email tells you about your new account and gives you a special client ID.

When you get the email, log in to your Zerodha account. Take time to learn about the platform’s features. Make sure you’ve set up your trading preferences and linked your bank account for easy transactions.

Also, download the Zerodha mobile app. This app lets you trade anywhere and see market updates anytime. It’s good to know about all the tools to make your trading better.

In short, verify your documents, get to know the platform, and set up your apps. These are key steps to complete your demat account.

| Step | Details |

|---|---|

| Document Verification | Submit ID proof and address verification documents for confirmation. |

| Account Confirmation | Receive confirmation email with account details and unique client ID. |

| Platform Familiarization | Log in to explore Zerodha dashboard and trading options. |

| Mobile App Installation | Download the Zerodha app for trading and market updates on the go. |

Best Platform for Demat Account Opening

Zerodha is the top choice for opening a demat account in India. It has a simple interface and is very reliable. Many traders choose Zerodha for these reasons.

Zerodha is also very affordable. Its fees are low, which means you save money when you trade. You get to choose from many trading options too.

Customer service at Zerodha is great. They help you set up your account and answer any questions. This is helpful for both new and experienced traders.

Zerodha also offers special tools like advanced charts and educational resources. These tools help you learn and improve your trading skills.

So, why pick Zerodha? It’s affordable, has excellent customer service, and offers cool trading tools. This makes it the best choice for opening a demat account in India.

Common Questions About Zerodha Demat Account

Many people wonder about zerodha demat accounts when they start trading. They want to know about fees and how long it takes to set up an account. This info helps with money worries and planning.

What Fees Are Involved?

People often ask about the costs of a zerodha demat account. Here’s a quick look at the fees:

| Fee Type | Details |

|---|---|

| Account Opening Fee | Zero |

| Annual Maintenance Charge | INR 300 per year |

| Transaction Fees | 0.1% of the transaction value |

| Penalty for Inactive Account | INR 50 per month after three months of inactivity |

How Long Does the Setup Take?

Many ask how long it takes to set up a zerodha account. It can take a few minutes to a couple of days. The time depends on:

- Online verification speed

- Document submission efficiency

- Customary banking response times

Conclusion

Opening a demat account in Zerodha is easy and important. It helps you trade securities smoothly. The guide shows how simple it is to start trading in the stock market.

Getting ready is key. You need the right documents and to know how to verify online. Follow these steps to open your account easily and confidently.

Whether you’re new or experienced, now is a great time to start trading. Open your Zerodha demat account today. Start exploring the financial opportunities waiting for you!

FAQ

How do I open a demat account in Zerodha?

To open a demat account in Zerodha, go to their website. Then, follow the steps to apply online. You’ll need to fill out a form and send in your documents for checking.

What is the zerodha demat account opening process?

Opening a Zerodha demat account is easy. You can do it online or offline. Just give your details and documents for checking. The online way is faster and easier.

What documents are required for demat account registration in Zerodha?

For a Zerodha demat account, you need an ID proof and address proof. You also need your bank account details. IDs like Aadhar, Passport, or Voter ID work. So does a recent utility bill or rental agreement for your address.

What are the common mistakes in the Zerodha demat account application?

Mistakes include wrong personal details or not signing the form. Also, sending documents that don’t match your details. Always check your info before you submit.

How long does it take to open a demat account with Zerodha?

Opening a Zerodha demat account takes less than 24 hours. This is if you use the online verification. After you send in your documents, your account will be ready soon.

What fees are involved with a Zerodha demat account?

Zerodha has a small annual fee for demat accounts. There are also fees for trading. You can find out more on their website. This helps you know what you’ll pay.

Can I open a Zerodha demat account offline?

Yes, you can open a Zerodha demat account offline. Just visit a Zerodha branch or talk to a representative. Fill out the form and give them your documents in person.

What to expect after applying for a Zerodha demat account?

After applying for a Zerodha demat account, you’ll get a confirmation email. You’ll know if your application is approved in a few hours to a day. This depends on the verification process.